Setting a budget is a lot like starting a new fitness regime.

It requires planning, discipline and perseverance.

Just like you need to burn more calories than you consume in order to lose weight, you need to save more money than you spend in order to maintain a healthy bank balance.

Most Gen Y avoid the unpleasantness and accountability associated with documenting expenses at all costs. Writing down what you spend is not only frightening and shameful but also limits our delightfully innate ability to self-delude.

The sad reality is that you did make a $200 withdrawal last week and it really has all been spent on coffee and food.

The good news is that adopting healthy spending habits is much easier than you think as small lifestyle adjustments can quickly lead to big rewards.

From The Starting Blocks

Many young Australians are now making a lifestyle shift from one of spenders to savers.

Developers have begun to recognise the potential of this burgeoning market by creating countless financial management apps and software to ease the transition and make creating a budget fun and simple.

Where To Train

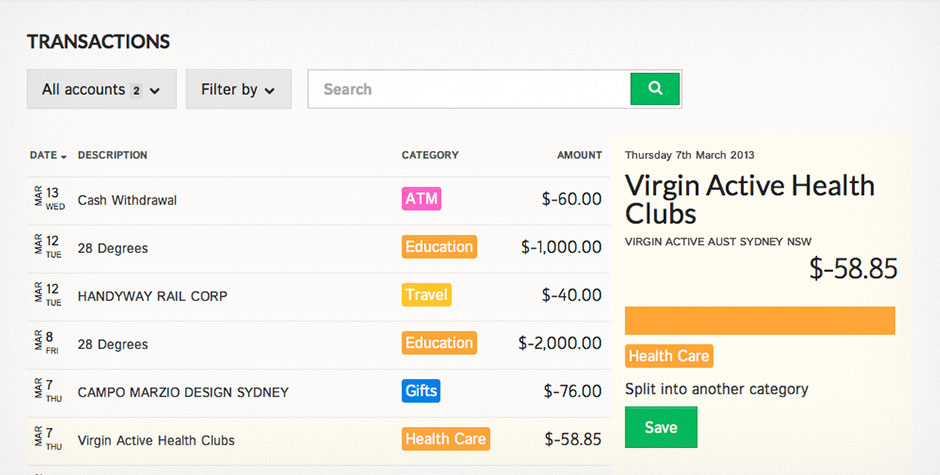

- Pocketbook – a free Australian budget planner available on iOS and Android.

The beauty of this app is that it shows you exactly where your money is being spent by automatically organising expenses into categories such as food, petrol and bills.

As the only personal finance app in Australia that syncs with your bank account, it factors in your income which gives you the ability to set saving goals and decide how much you can safely spend in a given week.

It even sends you notifications of upcoming bills, when you have gone over budget as well as any hidden fees charged to your account.

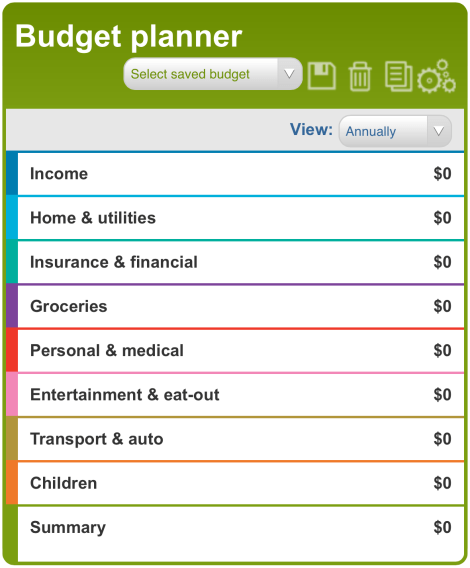

- ASIC’s MoneySmart budget planner is a fool proof, low-tech alternative to Pocketbook.

It allows you to work out where your money is going, add items and save results online.

Its clear, simple and easy-to-use interface is a good option if you are looking to start saving money quickly.

MoneySmart also offer a number of award-winning free apps and personal finance mobile tools such as TrackMyGoals (iOS & Android), TrackMySpend (iOS & Android), Mobile Calculator (iOS & Android) and Money Health Check (iOS & Android)

Download the free budget planner here.

- MoneySoft – available on Mac and PC.

Like Pocketbook, Moneysoft organises your expenses into categories, sends you notifications and schedules bill or loan payments by making sure you have enough money to cover upcoming expenses.

You can also set financial goals, such as a holiday, and the software maps out a plan to get you there.

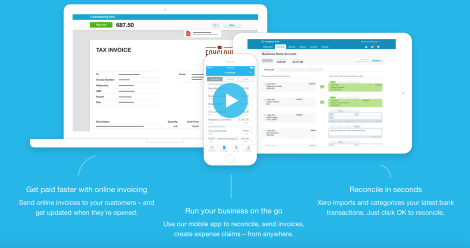

- Xero – available on Mac and PC. An excellent alternative for small business owners if you are looking for something a bit more robust to stay on top of your finances.

The software monitors cashflow, invoicing, payments as well as payroll and also comes with a smartphone app.

- Piikki – $4.99 from the App Store. If you are a small business owner, or are simply looking for an easier way to keep your receipts in one place, apps such as Piikki make your life instantly easier by organising and uploading receipts from your smartphone.

You can scan and send receipts directly to your accountant or upload them straight to the cloud. This means that you will never have to remember to keep another receipt again.

It also easily syncs with Evernote, Dropbox and Google Drive to track and organise your expenses.

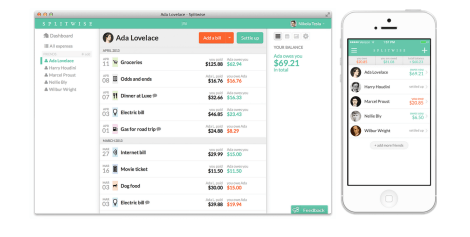

- Splitwise – available on iOS and Android. A very handy little app that helps you split expenses with friends and track who owes you money.

Splitwise helps you share bills and IOUs by making sure everyone is paid back.

Perhaps its best feature lies in its ability to determine who should pay what rent in share house situations and at what point a significant other should start contributing towards rent.

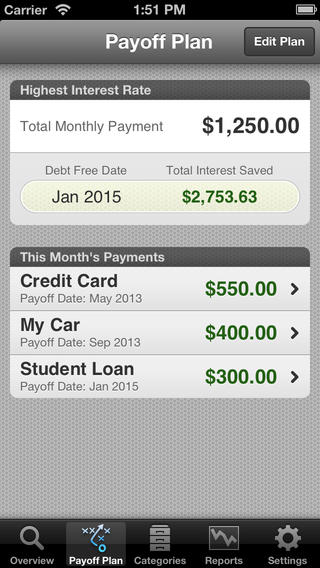

- DebtMinder – $1.99 iOS. DebtMinder is a fantastic tool that organises your big debts such as mortgage, loan or bill repayments.

via DebtMinder

It creates a personalised pay-off plan that takes into consideration interest rates and your minimum monthly repayments.

- Commonwealth Bank’s My Wealth service is another way to obtain a picture of your overall wealth. It combines your share account with your everyday bank account and any super funds or loans. The service also offers news likely to impact shares on your ‘Watch List’ and portfolio as well as other learning tools.

If you are based outside Australia, apps such as Mint and Level Money are excellent alternatives.

Ready. Set. Go!

Putting a budget in place is the first step to getting your finances on track. Just like building physical endurance, financial fitness takes time. The most important thing is to make a start and things will become easier.

A few quick strategies you can implement today:

1. Set Goals

Goals make the most daunting task feel worthwhile and achievable.

If your goal is to travel overseas next year, open a high interest savings account and transfer $15 per day until the trip. The amount is so small you probably will not even notice it, but the result will quickly add up to cover the cost of your plane ticket.

This method is simple but effective!

2. Cut down on daily expenses

Most of us place a high value on our morning coffee. As a culturally entrenched way to kick start the work day, network with colleagues or let off steam with friends, buying two or more coffees per day (between $3-$5 for a large flat white) can quickly add up to $75 per week!

Cutting back on coffees and placing this money into a high interest, however, can earn you over $5,000 per year.

Now consider how much you would have for your next holiday if you stopped buying lunches?

Finish Line

These apps, tools and strategies are just some of the quickest and easiest ways you can start to gain control of your finances, set a budget and work towards your dreams.

Think we’ve missed anything? Let us know what strategies you use to stick to your budget in the comments section below!