In the end we only regret the chances we did not take.

Travel is a wonderful and exhilarating adventure. But adventures and surprises often go hand in hand. Some surprises, like killer cases of food poisoning on a road trip are random, cruel and largely beyond our control. Other surprises, like a sobering roundhouse kick to your wallet by accumulated foreign transaction fees, we can control.

Travel is a deeply entrenched part of Australian culture. In the year ending June 2015, 9.2 million Australian residents returned after a short-term holiday overseas. According to Expedia, 83% of young Australians aged 18-24 plan to travel overseas in the next 12 months.

One of the most important, and commonly overlooked, aspects of an incredible trip is knowing how to handle your money. That’s why we put together what you need to know how to choose the best and cheapest travel credit card.

What You Might Not Know About International Transactions

When planning our trips, most of us focus on a strict savings plan with the intention of spending all our money once we are away. But an equally important aspect of travel is knowing how to save money by avoiding hidden banking and transaction fees which can quickly deplete your travel funds while you are still overseas.

Unlike domestic credit or debit card purchases in Australia, every transaction you make overseas with a card attracts additional charges. Currency conversion fees, international transaction fees and foreign exchange fees may apply.

International transaction fees from most major Australian banks usually amount to around 3% of the cost of your purchase. Most credit and debit cards charge between $4-5 for ATM withdrawals overseas.

What Is A Travel Credit Card?

A travel credit card is a pre-paid debit card that allows you to use your own money while travelling.

They are a popular choice for many travellers because they are easy to use. You can purchase a card any time meaning that you can load your card with foreign currency when the Australian dollar is strong and you can also load multiple currencies.

While overseas you can use a travel card for ATM withdrawals, shopping, restaurants, souvenirs, accommodation and online shopping. It is also possible to load more money or change currencies while overseas either online or using your mobile.

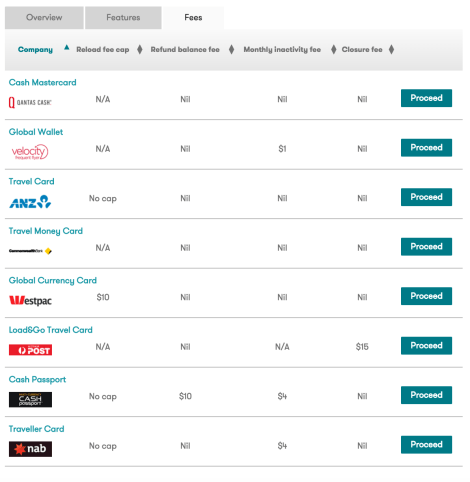

Canstar provides a great comparison of all major travel cards.

Source: Canstar

Travel cards are marketed as an effective way to avoid international transaction fees by allowing you to charge up a card with foreign currency prior to your trip. But where travel cards succeed in helping you avoid international transaction fees, they fail in reducing the cost of exchange rates.

Hidden Travel Card Charges & Problems

The below fees can amount to significantly higher fees and charges than you might expect. Some travel cards even charge up to 4-5% higher exchange rates than most average credit or debit cards.

- ATM Flat Fees – between $2-4 for ATM withdrawals overseas

- Initial Card Purchase – between $10-15

- Cash Re-load Fees – approximately 1.1%. Canstar’s 5-Star rated cards do not have a cash re-load fee

- Closing Travel Card Fee – approximately $10

- Currency Conversion Fee for changing currencies on travel card – between 3-5% of the value

- Card Top-up Fee – approximately 1% of value

- Wrong Currency Fee in cases where you have run out of local currency but have other currencies loaded on card – 5.95% of transaction

- Monthly Inactivity Fee where you return from holiday but have not closed your account – $4 per month

- Refund Fee to draw money you did not spend – approximately $10

Another major shortcoming of travel cards is the time it takes to recharge. If you use up the money you put on your card it can take up to 72 hours for additional funds to be processed, meaning you could be stranded without cash.

Cheapest Credit And Debit Cards

To avoid high international transaction fees, many travellers withdraw large sums of cash in their destination city, however, it is never safe to travel with large sums of money on you.

Your best option is to travel with a low fee debit or travel credit card (below) and to withdraw small amounts of cash for food and incidentals as you need, using your debit or credit card for most other purchases. It is a much more secure way to travel than with cash or travellers cheques.

ING Direct Orange Everyday Visa Debit Card

- No annual fees

- 2.5% of transaction amount for international purchases

- $2.50 international ATM withdrawal fee

- No currency conversion fee

- No annual fees

- No currency conversion fees

- No international transaction fees (purchases)

- 3-4% international transaction fees (cash withdrawal)

- 3% ATM withdrawal fee

- No annual fees

- No international transaction fees for purchases

- No international transaction fees for ATM withdrawals

- No currency conversion fees

What Else Should You Do Before You Travel?

It is easy to forget important last-minute tasks before leaving on your next big adventure. Don’t forget to:

- Let your travel credit card company know that you are travelling overseas, and where you are going, to avoid your card being blocked unnecessarily. With ING Direct you can do this quickly and easily, even while waiting at the airport, by using their mobile app.

- Buy travel insurance to protect yourself in case anything goes wrong while you are overseas.

- Check the Smart Traveller Travel Advisory page to find the risk of travelling to your chosen destination and other useful information.

- Register your travel plans with the Department of Foreign Affairs and Trade (DFAT). This ensures the Australian government knows where you are and how to reach you in an emergency.

- Print several copies and save electronic copies of all your documentation. This includes copies of your passport photo page, your itinerary, your vaccinations, visas and accommodation details. Leave a copy of everything with someone at home and take two copies with you in case one copy is lost or destroyed by a leaky bottle of shampoo. Place one in your main bag and one in your carry on bag for reference.

- Write down the contact details of the Australian Embassy in the country you are visiting in case of an emergency.

Life is too short to wait. Dust off your suitcase and go travel!

What are your favourite cards for overseas travel? Let us know in the comments section below!